Combating invisible financing for terrorism

CCTV footage played the key role in identifying the suicide bombers of the Easter Sunday attack. However, the ways and means of breeding such terrorism on Sri Lanka’s soil is still under investigation. In the aftermath of the Easter attack, there is heighted attention on countering financing of terrorism. Informal/illegal remittance schemes can be seen as one of the main mechanismsused for fund transfers by terrorists.

International soft law making bodies such as the Financial Action Task Force (FATF) and domestic law enforcement authorities make efforts to put frameworks in place to curb informal and illegal remittance schemes. However, reports of investigations into terrorist activities reveal that such systems are in operation parallel to formal financial systems. This article intends to highlight some salient aspects of illegal remittance schemes which pose severe threats to national security, integrity of financial systems and promotion of economic growth.

According to the Financial Crimes Enforcement Network (FinCEN), any system, mechanism or network of people that receives money for the purpose of making funds or an equivalent value payable to a third party in another geographical location, whether or not in the same form, is considered as an Informal Value Transfer System (IVTS). A system called Hawala in Middle East and Asia, Fei-Chin in China, HuiKuan in Hong Kong, Pei Kwan in Thailand, Hundi in Pakistan and India and Undiyal among Sri Lankan Tamils, black market peso exchange in Colombia and Padala in Philippines are examples of IVTS.

This article will focus on the ‘Hawala’scheme which is considered a widely used form of IVTS.It has originated in the Middle East and South Asia. Although at its origins,the Hawala system facilitated trade and helped to mitigate therisk and inconvenience of physical transportation of money, it is reported that after 9/11 attack Hawalabecame associated with terrorism financing. However, in areas where there is lack of access to conventional banking Hawala functions as an alternative remittance system.

In the Arabic language Hawala means ‘transfer’.Trust between the involved parties is the main attraction of the Hawala system.Moreover, the low or no cost for the remitters, speed of the transfer, anonymity, convenience for the recipients and the lack of rigid formalities, suitability for cultural aspects are considered as other attractive elements of the Hawala system. It is also observed that the Hawala is used to evade currency controls, international sanctions, and taxes as well as to transfer criminal proceeds.

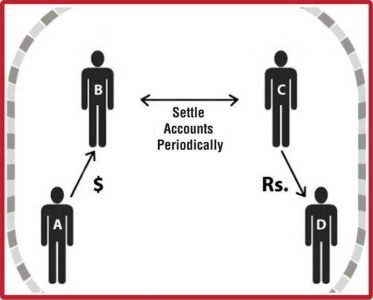

The multifaceted description of Hawala indicates that it is a mechanism of transferring money without physically moving it.The diagram elaborates a simple Hawala transaction.

[A] Customer (usually a migrant worker but it could be any other person) approaches a [B] Hawala broker (Hawaladar) and gives him a sum of money to be sent to a recipient in another country.[B] contacts their Hawala partner [C] in the recipient country via phone or fax or email.[A] gives the information on the beneficiary, amount, name, address, telephone number of the recipient to [B].However, [B] doesn’t remit money to [C].[B] agrees to settle it later and [C] pays to the recipient (D). Therecipient will have a password or code number to get money from [C].No written contract for the transaction is available and the deal is secured by the trust between parties.

Two Hawaladars i.e. [B] and [C] settle their dues at a later stage through under invoicing, transferring money through banks or cash carriers. Researches reveal that Hawala brokers mostly involved in import/export activities. They charge a modest commission and use a more favourable exchange rate than the mainstream banks.The Hawala broker in the recipient country does the delivery of money free of charge.Since the Hawala does not create a paper trail it gains traction for illicit transactions such as terrorist financing, tax evasion, exchange control violations and import/export frauds.Therefore, the debt settlement can be done by manipulating invoices i.e. under-invoicing or over-invoicing shipments of goods.Smuggling gold and precious items is another way of settling dues between Hawala brokers.

In an article titled ‘A Banking System Built for Terrorism’ published in Time Magazine (2001) the following description had been given for illegal remittance systems. In the labyrinthine depths of Old Delhi, (…) nobody seems to be doing any work, until the phone rings.Then numbers are furiously scribbled, followed by some busy dialling and whispered instruction.Although it’s far from obvious in the innocuous setting, these men are moving money – to exporters drug traffickers, tax evaders, corrupt politicians. And terrorists.The regulatory empowerment in Sri Lanka should also be widened to detect such money movers in the country who are engaged in criminal activities.

It is observed that criminals take advantage of the anonymity of the Hawala system to move the proceeds of illegal activities.Since the documentation involved in the Hawala deals is minimal, it makes the system vulnerable to be abused for money laundering and terrorism financing.

According to Timothy O’ Brien, Al Qaeda has used the Hawala system to fund the American Embassy bombings in Kenya and Tanzania in 1998.Columbian drug traffickers have also used Hawala as their main remittance system.The Irish Times reported (2016) that Hawala was used to fund the Paris attack in 2015.As per the International Business Times (2015) the Boko Haram Organization in Nigeriais known to receive money through Hawala.In 2005, FATF also acknowledged the potential misuse of Hawala by criminals. The FATF states that Hawala, controlled by criminals, functions as networks for other offences including tax fraud, currency offences and corruption. According to the Interpol reports, the Hawala system facilitates money laundering by placing illegal proceeds in formal financial institutions pretending they are earnings of a legitimate business.Front Companies operated by Hawala dealers assist these placements.They complete the layering of criminal proceeds distributing transfers over a period of time.

At the ‘integration’ stage of the money laundering process, illicit money is invested in legitimate businesses, purchase of property or import/export invoices.Netherlands authorities have found out that laundromats, grocery stores and phone shops have been used as illegal money remittance businesses.During 2010-2012 eight million Euros have been seized by the Public Prosecutor’s Office in Amsterdam. In 2011 Manhattan Federal court arrested a person operated an unlicensed money transfer business between the USA and Pakistan.

One of its transactions was used to fund the attempted car bombing in New York City’s Times Square in 2010.The owner of an ice cream shop named Carnival Ice Cream was arrested in Brooklyn, in 2003.He maintained an account in J.P Morgan Chase Bank to collect the funds to be transferred to Al Qaeda. The UAE, in collaboration with the United States Department of Treasury, blocked AlBakarat’s (a Somali based Hawala operation) assets in Dubai.

Source: FT